Your rates help us deliver a wide range of services to benefit you and the wider community.

Every single dollar of your rates tax is used to fund the delivery of all the services and infrastructure works as laid down in the annual budget following consultation with the community. Unlike other taxes (e.g GST, income tax, payroll tax) rates enables services and infrastructure to improve amenity in the area where you and your community live.

You can pay your rates:

- in full by 1 September; or

- in four instalments (due 1 September, 1 December, 1 March and 1 June each year)

If you are unable to make payments by the due date please contact us on 8408 1111. If you get in touch before the due date, we can avoid recovery action. There are payment alternatives available, but late payment penalties still apply.

You can also use the payment portal below to check your current balance at any time.

- See our other payment methods

- Receive your rates notice by email with EzyBill

- What happens with late payments

- You can get rate relief - rebates and concessions

- Sold your property? Sale of property - transfer advice

- Have your details changed? Change of address or name form

Pay Online

BPAY

It’s quick and easy to set up BPAY payments.

BPAY/BPAY VIEW Use Biller Code: 10330

Reference Number: Enter your payment reference number as shown in the Property Details box of your rates notice. Enter all characters without spaces.

Direct debit

You can have fortnightly or quarterly payments debited from your bank account.

- Read the Direct Debit Service Agreement before completing the Direct Debit Request Form

- Complete our online Direct Debit Request Form

Centrepay

Use Centrepay to arrange for regular deductions from your Centrelink payment.

Centrepay reference is 555 058 962J.

Over the phone

8408 1111

1300 609 653 at all hours

In person

The City of Charles Sturt Civic Centre

72 Woodville Road, Woodville

8:30am to 5pm Monday to Friday (excluding public holidays)

For security reasons, cash payments are not accepted at Henley Beach, West Lakes, Hindmarsh or Findon libraries.

You can also pay in person at any Australia Post outlet.

By mail

You can pay by cheque, money order or credit card to:

City of Charles Sturt

PO Box 1

Woodville SA 5011

Cheques should be payable to the City of Charles Sturt and crossed “Not Negotiable”. Please allow 6 business days before the "Last Day To Pay" for payments sent by mail.

EzyBill

Switch to receive your rates notice electronically via EzyBill

Receiving your rates notice electronically is a great way to go paperless and reduce waste, helping the environment.

By registering for EzyBill you will receive your rates notice via email and will have access to it on the EzyBill portal from any electronic device when you need it.

- Register with EzyBill (if you have previously registered with another Council for EzyBill, you can use the same login details).

- Once logged in, click ‘Add New’ and follow the steps to register (you will need your latest rates notice to fill in the required information).

- Keep an eye out for your next rates notice arriving in your inbox.

Once you are registered the next quarterly rates notice will be delivered via email and paper notices will no longer be issued. You will be able to view all future rates notices in the EzyBill portal.

You can still choose to make payment via your preferred payment method or for convenience click on the ‘Online Payments’ section of the notice to pay by Credit Card on the Council website.

Important Information

BPAY View

If you are already registered for BPAYView rates notice delivery and you register your property for the EzyBill delivery option, once the EzyBill registration has been accepted you will automatically be deregistered from BPAYView.

Rates Notice

You will only receive your quarterly notices via EzyBill. All other correspondence from us will be issued to your postal address so please ensure you keep your details updated with us. Only if your electronic notice is returned to EzyBill as undeliverable will a paper copy of your notice be issued to your postal address.

Registration by Ratepayer/OwnerRatepayer/Owner details must match with who is registering for EzyBill.

If you need to register on behalf of another person, a written authorisation or a power of attorney type legal document must first be provided to us prior to registration.

Haven’t received your notice? If you have registered for EzyBill and have not received your next rates notice, check your junk folder on your email. Depending on your internet service provider (ISP) it may be marked as a possible virus threat. To avoid this happening check your email settings and whitelist noreply@ezybill.com.au or contact your ISP if you need assistance.

Need help?

Rating Services

8408 1111

council@charlessturt.sa.gov.au

Late Payments

An initial penalty of 2% on any payment for rates that is received after the due date (applied in accordance with the Local Government Act).

A further penalty at the prescribed interest rate is added to any unpaid rates at the end of each month they continue to be unpaid. (The prescribed rate for 2023/2024 is 9.05% p.a.)

Failure to Pay

If rates remain unpaid more than 21 days after the issue of a final notice, the debt is referred to a collection agency (this process incurs additional costs to the ratepayer).

When a payment is received, the money is distributed in the following order:

- to pay any costs awarded in connection with court proceedings

- to pay any interest costs;

- to pay any fines imposed;

in payment of rates, in chronological order (starting with the oldest rate account).

Sale Of Land For Failure to Pay

The Local Government Act allows a Council to sell any property where rates have been in arrears for three years or more.

Rate Relief Provided By Us:

Rate Increase Capping for Residential Properties - No Need to Apply

If our records show you are eligible, your rates account will be automatically adjusted to limit any rate increase to 12.5% of the rates paid for 2023/24.

This capping rebate is provided to reduce the impact on residential ratepayers whose rates have increased substantially this year due to rapid changes in valuations.

To be eligible, the increase in rates levied of more than 12.5 percent (excluding the Regional Landscape Levy) cannot be as a result of:

- improvements made to the property worth more than $20,000; or

- a change to the land use of the property; or

- ownership of the rateable property has changed since 1 July 2022.

If you believe you meet the criteria for the rate capping rebate and a rebate does not appear on your rates notice, please contact us.

Note: ratepayers should appreciate that there can be a delay in valuations being adjusted for improvements made to a property by the Valuer General, spanning over financial years.

Postponement of Rates for Seniors

If you or your spouse currently hold a seniors card and your property is you or your spouse's principal place of residence you may be able to defer the amount of your rates that exceeds $500 until your property is sold. Other criteria apply. Interest will accrue on the deferred amount.

Postponement of Rates for Seniors

Vacant Land - Rebate for Construction (Residential)

If you are building your new family home in 2023/24 on land classed as "vacant land" on your annual rates notice for 2023/24 you may be eligible for a rate rebate.

Please note is the intention of this rebate to only apply to one dwelling and to the ratepayer who will reside in Charles Sturt for at least one year and consequently where multiple dwellings are proposed on Land (with or without division of the land occurring) the rate rebate will apply to only one of the dwellings, on a pro-rata basis.

If concrete footings were laid prior to 30 June 2023 and your rates are vacant land for 2023/2024, do not complete this form. Instead contact the Rates Department immediately.

For more information and how to apply:

Residential Construction Rebate

Applications must be received before close of business 30 June 2024.

A person wilfully making a false declaration is liable to substantial penalty.

Hardship - Arrangements for Special Circumstances

If you are experiencing difficulties meeting your rates payments and are experiencing financial hardship, please contact us on 8408 1111 to arrange tailored payment plan to meet your circumstances. All arrangements are strictly confidential.

Community Purpose Land - Rebate of Rates

Rate rebates apply for land used for health and community services, religious purposes, cemeteries and educational institutions. These rebates vary from 25% - 100%.

If you believe your organisation may be eligible for a discretionary rebate you will be required to lodge an application form by 30 April each year.

State Government Concessions

If you are a holder of a pensioner concession card, veterans, low income earners, unemployed students and self-funded retirees you may be eligible to receive a concession. Instead of being provided as a deduction on your rates notice against rates paid you will now get the money paid directly into your bank account and you can use the money to contribute to any of your household bills.

These payments of up to $200 may be used to offset council rates by the recipient.

To check eligibility, contact the Department of Human Services Concessions hotline on 1800 307 758 or at www.sa.gov.au/concessions

Rates are a type of property tax. Each ratepayer contributes based on their relative property valuation. But this valuation does not affect the total amount of rates the Council collects. We only collect the amount of money required to provide services and infrastructure in our annual budget.

As rates are a tax (like income tax and GST) the rates paid may not directly relate to the services used.

We calculate rates for each rateable property by multiplying the value of a property (capital value as assessed by the Valuer General), by the 'rate in the dollar' (RID).

We calculate the 'rate in the dollar' by dividing the sum of rates required in our annual budget by the total valuation of properties in our Council's area.

There are different types of 'rates in the dollar'. They depend on the type of land use, eg residential, vacant land, commercial, etc.

| 2022/2023 | 2023/2024 | |

|---|---|---|

| Residential | 0.00209613845 | 0.0019807268 |

| Commercial | 0.007677619490 | 0.0070838679 |

| Industrial | 0.008762431000 | 0.0075577931 |

| Vacant Land | 0.00737237120 | 0.0062062993 |

| Primary Production | 0.005226429479 | 0.0045306011 |

| Other | 0.003389847530 | 0.0030844203 |

We also have a minimum rate to ensure all ratepayers contribute to basic services at a reasonable level. In 2023/24 the minimum is 1,204 which means if the RID multiplied by the capital value is less than the minimum, the minimum is still levied.

Refer to Council Rates and Property Values fact sheet for more information.

Your property's capital value assessment is used to determine your rates. It comes from a Government valuation adopted by this Council.

You may object to the valuation referred to in the annual instalment notice. If you wish to object, you must lodge it in writing to the Valuer-General within 60 days of service of the annual instalment notice. State the grounds for your objection and include information to support your application.

But please note:

If you have previously received a notice under the Local Government Act 1999 referring to the valuation and informing you of a 60 day objection period, the objection period is 60 days after service of the first such notice;

You may not object to the valuation if the Valuer-General has already considered an objection by you to that valuation.

Objection forms

You can get them from the Office of the Valuer-General or access objection forms online.

Send your objections to the Office of the Valuer-General:

101 Grenfell Street, Adelaide, GPO Box 1354, Adelaide SA 5001

OVGObjections@sa.gov.au

1300 653 346

If your objection is upheld, the Valuer General will advise Council and your rates notice will be amended.

Please note: The lodgement of objections for rates does not change the due date of payment for rates.

Differential General Rates imposed by the Council are based on various land use categories. If you consider that the land use category is incorrect you may object, in writing within 60 days after the date of service of the First Instalment Notice, to the Chief Executive Officer, City of Charles Sturt, PO Box 1, Woodville SA 5011. State the grounds for your objection, your opinion of the correct land use and include information to support your application. Please be aware some changes require planning consent.

If your objection is upheld, your rates notice will be amended.

Please note: The lodgement of objections for rates does not change the due date of payment for rates.

The Regional Landscape levy (previously known as the Natural Resources Management levy (NRM)) is a State tax. Councils are required under the Landscape South Australia Act 2019 to collect the levy on all rateable properties on behalf of the State Government.

The City of Charles Sturt is operating as a revenue collector for the Green Adelaide Board. Revenue from this levy is not retained by the Council, nor do we determine how the revenue is spent.

In 2023/24 the Regional Landscape levy to be collected by Council will be $3,430,094.

The levy helps to fund the operations of regional landscape boards who have responsibility for the management of the State’s natural resources. These responsibilities include regional landscape planning, water allocation planning, community capacity building, education and compliance activities.

For further information regarding this levy, or the work the levy supports, please visit the Green Adelaide Board at www.landscape.sa.gov.au or phone 7424 5760. They can be contacted via email at dew.greenadelaide@sa.gov.au.

Council has to pay various levies and charges from the rates tax it levies. This is as well as the Regional Landscape Levy of $3.43 million which Council must collect from its ratepayers on behalf of the Green Adelaide Board.

Other levies and charges Council must pay from the rates collected include:

- solid waste levy

- emergency services levy

- planning levies

- dog and cat management fees

- library levies

- motor vehicle registrations

- legislated mandatory rebates including housing associations, schools, churches. In this case, council levies rates but must then grant a rebate

Total levies and charges as detailed above equates to approx. 11% of total operating costs (excluding depreciation)

For an average residential ratepayer paying $1,679 in rates, approx. $185 goes towards paying for other government levies and charges.

There are lots of reasons why rates continue to increase.

- Infrastructure like roads, footpaths and stormwater must be maintained to an acceptable standard as outlined in Asset Management Plans.

- The community continues to want a broad range of services with an increasing quality of service.

- Rising costs of water, electricity and waste. We have responsibility for public lighting, domestic and hard refuse collection, and watering 350 hectares of open space.

- Changes in legislation by State government without any cost recovery such as the changes to the Local Nuisance Act.

- Other changes in legislation where the cost of the service is far greater than the legislated fees such as in planning and building, food inspections.

- Continued increase in mandatory rebates to supported accommodation of 75%. Over the last 10 years this has cost $1.9m in lost revenue (233% increase).

- Continued increase in EPA waste levy. In 2019/20 there was an increase of $10 per tonne from 1 July 2019 and then another $30 per tonne on 01/01/2020, a total of 40%.

- Since July 2010 the waste levy has increased from $26 per tonne to $149 per tonne. This is an increase of 473%

- Increase in emergency services levy which has increased since 2007/08 by in excess of 228%.

- Staffing costs endorsed in line with the current Enterprise Bargaining Agreement. As a service industry, employee costs make up 36% of our total operating costs.

- Since 2019/20 the cost of diesel has increased by 42%

As a Council, we must manage these rising costs to ensure rates remain affordable.

We're doing this in a number of ways.

- Ongoing reviews to ensure services are efficient and effective with value for money.

- Increases in staffing must be justified through a business case for review by Council.

- Recurrent budget is developed annually using zero based budgeting to ensure cost savings are captured.

- Ongoing budget assurance work in reviewing trends in spending.

- Lobbying against legislative changes that impose costs to Council without cost recovery.

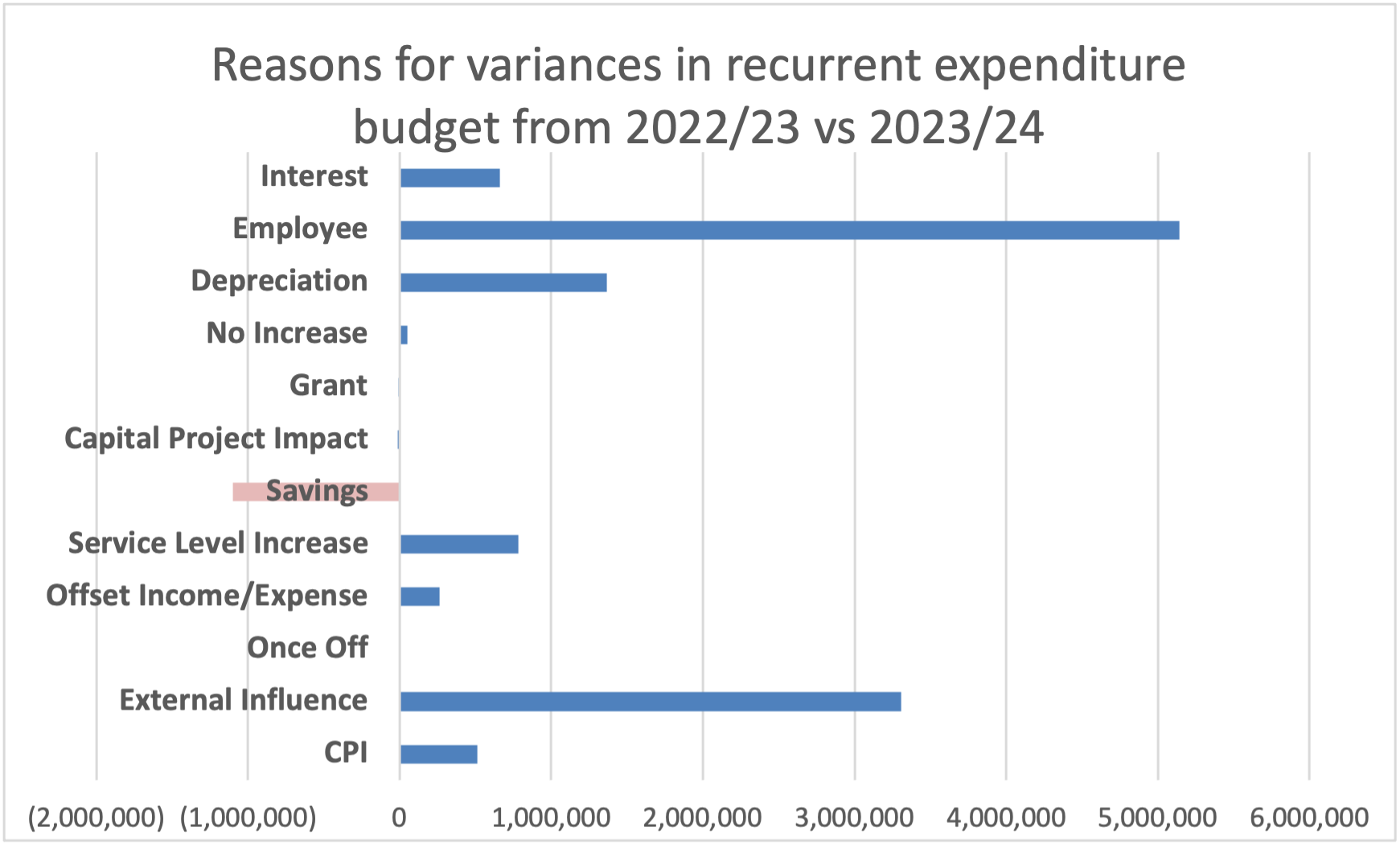

For 2023/24 council was able to ensure rates increases remained less than CPI by offsetting the impact of external influences, EB wages increases and service level increases by capping budgets at either at a nil increase or savings. Overall $903k in budget efficiency savings was delivered in the development of the recurrent budget on the LTFP forecast.

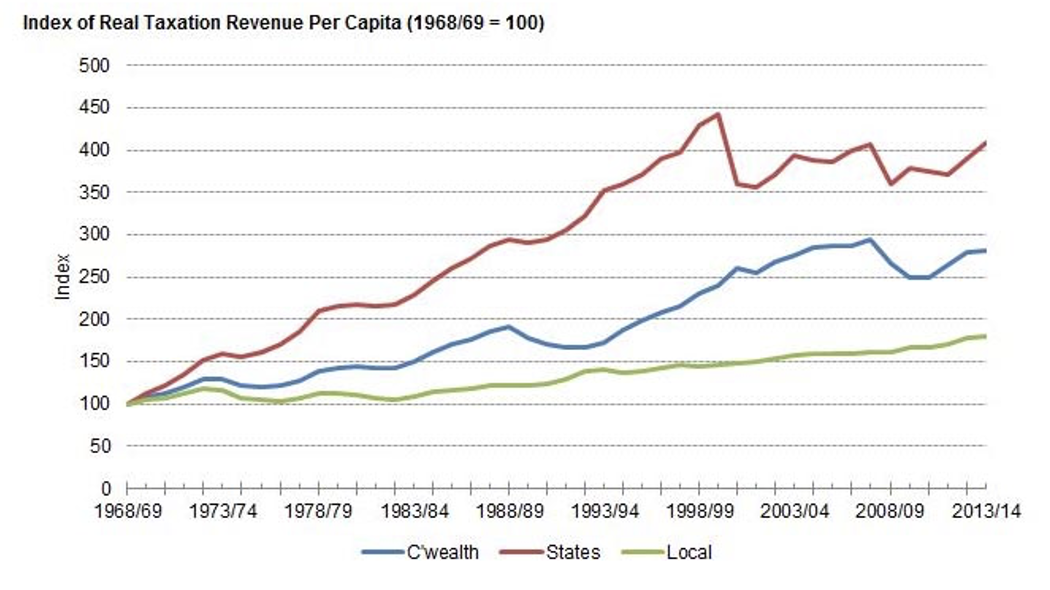

Council rates in Australian have grown the lowest of all tax revenues from each area of Government over the past 45 years.

This is according to independent data prepared for the Local Government Association (LGA) by the SA Centre of Economic Studies (SACES).

No, not necessarily.

Council rates are a type of property taxation. Property value has an important part in working out how much each ratepayer pays, relative to another.

Because it's a system of taxation the rates paid may not directly relate to the services used by each ratepayer. Once Council works out its budget, we work out how much money we need to raise from rates. We then divide the total of all individual property values in the area to come up with the "rate in the dollar".

With this system, we can multiply the rate in the dollar (RID) by individual property values to get the rates bill for each property. We then know that the rates paid will equal the same amount set in the budget to be raised from rates.

Valuations do not determine the rates income of a council. They are used to divide the total rates amount among individual ratepayers.

Property values are only one part of the calculation for how much each ratepayer pays. Councils must review the rate in the dollar annually. This makes sure they only raise the budgeted rate revenue as required.

For example: a person with a property value of $950,000 will contribute relatively more than someone with a property value of $600,000.

In 2022/23 residential property valuations increased by 22.85%, yet the average increase in residential rates was 2.69%. To ensure the Council only collected enough in rates to pay for the costs of all services and infrastructure as laid down in the budget 2022/23 the RID was reduced.

| 2022/2023 | 2023/2024 | |

|---|---|---|

| Residential | 0.00209613845 | 0.0019807268 |

| Commercial | 0.007677619490 | 0.0070838679 |

| Industrial | 0.008762431000 | 0.0075577931 |

| Vacant Land | 0.00737237120 | 0.0062062993 |

| Primary Production | 0.005226429479 | 0.0045306011 |

| Other | 0.003389847530 | 0.0030844203 |

To get a previous copy of your rates notice you can choose one of the following options:

- Call us on 8408 1111

- Open a live chat request (Available Monday to Friday 8.30am to 5.00pm)

- Email council@charlessturt.sa.gov.au

- In person at the front counter of the Civic Centre (72 Woodville Road, Woodville)

- By mail: PO Box 1, Woodville SA 5011

You can request your rates notice to be posted or emailed out to you by the above methods. Please allow up to 5 business days to action your request (it could be longer if we need to mail it to you).

There will be a cost of $11.00 per account copy for previous financial years and no charge if it is for the current financial year.

If you are already signed up for EzyBill you can access previous rates notices on their portal for free. Please note that you can only access previous rates notices from the day you have signed up.

We are often asked if ratepayers are eligible for rate reductions during roadworks, due to the disruption they are experiencing.

Rates are a form of taxation. The amount each ratepayer pays (in rates) annually contributes toward the amount of money required to deliver the services, infrastructure and projects across the City of Charles Sturt, as endorsed in the annual budget. As a tax, the rates paid may not directly relate to the services used. Allowance is made in the budget each year for a suite of rate rebates and rate relief as outlined in our rating policy. There is no rate rebate or rate relief for disruption caused by roadworks.

Road assets need replacing and upgrading to ensure they remain safe and accessible for our community, in line with our asset management plans. New infrastructure is required to ensure we continue to meet the changing needs of our community. Asset replacements/upgrades and new assets are planned for in our long term financial plan, to ensure that the cost of assets is fairly distributed across the life of the asset. We are often successful in obtaining external grants from the State and Federal governments, to deliver asset upgrades and new assets that provide even better value for money for our ratepayers.

Some level of disruption is unavoidable while the assets are being replaced, however the investment by Council benefits the ratepayers once works are completed.

If you are a business or homeowner experiencing hardship in paying rates, you are able to apply for rates deferrals and/or payment plans to support you through the time of hardship. See our Rate Relief information.