Kerbside Bin Collection Delays

Read More

Council Endorses Community Consultation for Football Park

Read More

Construction Underway on New Spad Street Reserve

Read More

ANZAC Day 2024

Read More

Updated Statement on Football Park

Read More

Share Your Thoughts on our Draft Annual Business Plan

Read MoreWhat's On

-

27Apr24

27Apr24Ukrainian Easter Festival

Ukrainian Community Centre and Women's Association Museum, Hindmarsh -

27Apr24

27Apr24Watercolour Wash & Print Workshop

Henley & Grange Community Centre, Henley Beach -

29Apr24

29Apr24Free apps with your library card

Ngutungka West Lakes, West Lakes -

30Apr24

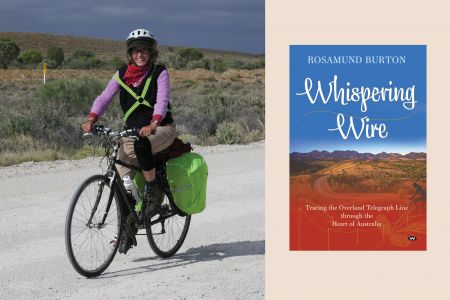

30Apr24*CANCELLED* Author Talk with Rosamund Burton - Whispering Wire

Ngutungka West Lakes, West Lakes